Everything you need to know about VYBE, BPI's new e-wallet

There's a new e-wallet in town called VYBE, and it's aiming to be a one-stop lifestyle app for Filipino users.

Developed by the Bank of the Philippine Islands (BPI), the app was launched last Oct. 26 and is now available for download through the App Store and Google Play. Similar to its competitors, VYBE will let users simply scan and pay via QR code and do cashless transactions.

Here's what you need to know about this new e-wallet.

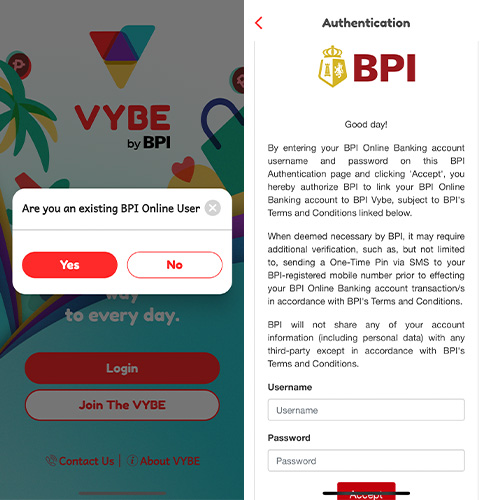

Signing up

To create an account, you must be an existing online BPI Online user. You'll need your username and password from that account to register a VYBE e-wallet. Then, enter the six-digit code sent via SMS to your registered mobile number.

You will then be asked to nominate a four-digit MPIN, which will be the code you'll use to open your VYBE account.

What can you do with VYBE?

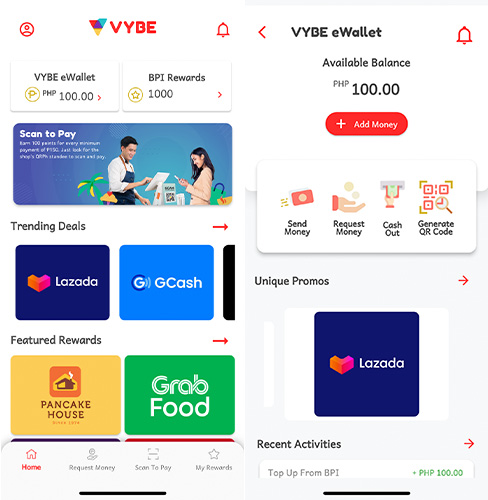

A BPI e-wallet, VYBE lets you send and move money to and from your account for free. Like GCash and Maya, this app also lets you send and request cash from other VYBE app users without additional fees as well as scan partner merchants' QR codes to pay when you shop or dine.

In addition, VYBE lets you earn reward points which you can use to redeem vouchers and discounts from brands such as Pancake House, GrabFood, Chatime, Jollibee, Krispy Kreme, 7-Eleven, Zalora, The Coffee Bean & Tea Leaf, and 8Cuts. You can also share your points with other users through their mobile number.

Users who sign up get 1,000 points as a welcome gift.

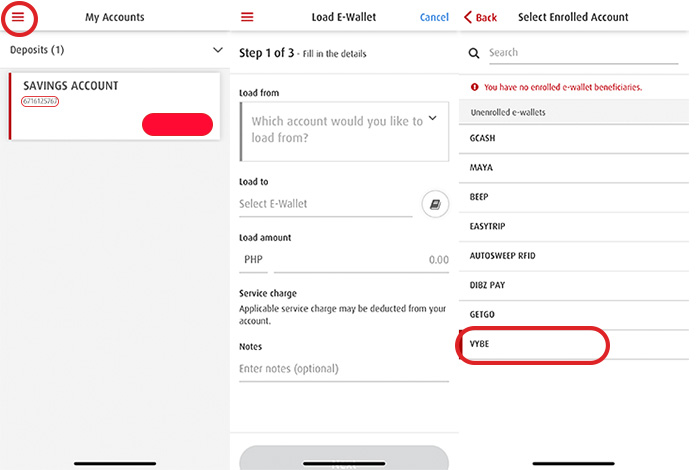

To add money to the e-wallet, open your BPI Mobile app, log in, and tap on the icon on the top-left part of your screen. Tap on Payments/Load > Load E-Wallet. Select the account you want to load from and select VYBE under Load to section.

Enter your BPI registered mobile number in the Reference Number space, how much you want to transfer, and tap on Next to confirm. You will get a notification on VYBE about the transaction.

According to BPI Vice President and Head of Digital Partnerships and Ecosystems Frederick Faustino, the company is working on allowing non-BPI users to open an account and on letting users use the e-wallet for cardless withdrawals.