Oh my gulay: Commodity prices are now the highest in two years

The Philippine economy has yet to regain its bearings and now another challenge rears its head—high commodity prices.

Anybody who has been going to the market for the past few months have been feeling the pinch as prices of food items have been going up, up, and up without any let-up. Because of this, the headline inflation rate — which tracks the rise of prices in a basket of basic goods and services — went up to a two-year high of 4.2% in January.

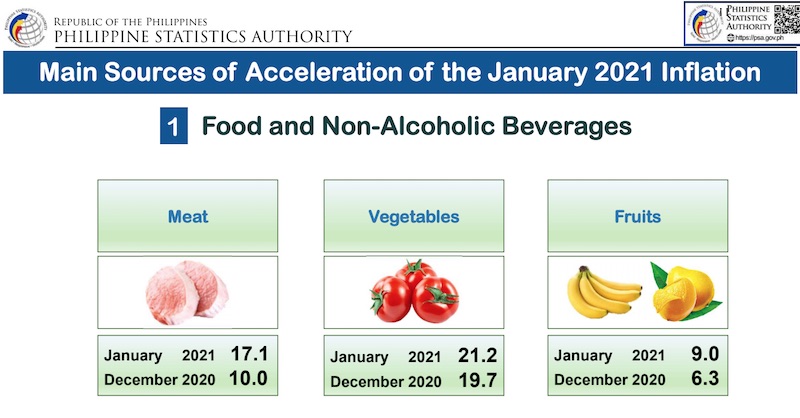

Last month’s inflation was driven mainly by a surge in food inflation, which was mainly meat and vegetables.

Pork prices, for one, have been going up so much some consumers are already having hypertension just by asking prices. Prices of lean pork are now going in the vicinity of P400 per kilo in some markets. Supply issues usually hound hog raisers at the start of the year, as farms tend to clear their stock to accommodate the high demand during the holiday season. But the problem was compounded this year by the blight of the African Swine Fever, that has been depleting local supply to record lows as various farms were forced to cull their stock.

To address the increase in meat prices, the government has set price caps on pork and chicken and allowed more imports, stop-gap measures that may help tame prices for a bit but can not of course address the underlying supply-side issues.

Prices of vegetables and even fruits, meanwhile, remain high due to tight supply from supplier regions following the string of typhoons last year. More so, oil prices also remain elevated, further adding to business costs.

Temporary

Though the January inflation was beyond the 3.3-4.1% forecast range of the Bangko Sentral ng Pilipinas, the central bank nevertheless said this “uptrend in inflation is seen to be temporary.”

Acting Socioeconomic Planning Secretary Karl Chua said their “priority right now is to ensure that food supply is adequate so that households affected by COVID-19 and the quarantines will not be doubly affected by the increase in food prices.”

For policy think-tank Ibon, the faster-than-expected inflation underscored the urgency for the government to give new cash subsidies to the poorest households.

Moving forward, the record-high inflation may also stay the hand of the BSP in further cutting down interest rates. Last year, the BSP cut rates five times in a bid to jumpstart the flagging economy hit hard by the pandemic. As the monetary board meets on Feb. 11 for its first policy meeting for the year, higher commodity prices may give regulators second thoughts in further trimming its key policy lending rate.

(Thumbnail and banner photo from The Star/Michael Varcas)