Investing your way: The three types of investors

Each individual has a unique personality even when it comes to investing. Though no two investors are alike, there are patterns of investing that can help you identify your trading personality, which depends on how much risk you can tolerate.

When it comes to investing, the higher the risk, the higher the expected returns. However, high-risk portfolios are not everyone’s cup of tea. Some investors may prefer lower risk exposure in exchange of modest returns. Knowing your investor type is important to help you put your investments to work in a way that suits your preferences, personality, and risk appetite.

Understanding risks in the global market

Most Filipino investors prefer to invest locally through the 30 Philippine-based companies that comprise the Philippine Stock Exchange Index (PSEI) because of convenience and easy access to blue-chip companies. However, if you’re looking into diversifying your portfolio, the best way is to start investing globally. Many first-time Filipino investors are hesitant to try investing in international markets because of lack of information and the risks that come with it.

Identifying your investor type helps you gauge the risks you will take considering the various factors that affect global investing. Three of the most common risks investors face in foreign markets are: currency differences and volatility, political risks, and lack of accessibility to international markets.

Many first-time Filipino investors are hesitant to try investing in international markets because of lack of information and the risks that come with it.

Currency differences and volatility are risks related to currency fluctuations. When trading in foreign markets, currency changes are inevitable depending on which way the forex market is headed. The political environment, which can be unpredictable, is another factor that affects global markets. The lack of accessibility to international markets also limits investors from diversifying their investment portfolios and expanding outside the local market.

Let’s be honest, investing in foreign markets does not come easy for Filipino investors. On top of the perceived risks, most Filipinos are intimidated to start because they don’t have the financial bandwidth to invest in international markets.

Now, Filipino investors can easily diversify their portfolio into global investments without overstretching their finances through AIA Philam Life Elite Funds in collaboration with AIA Investment Management Pte. Ltd. (AIA IM).

Available through its unit-linked insurance products, the new AIA Philam Life Elite Funds are designed to maximize the earning potential of common Filipinos' hard-earned money through global funds. Policyholders may choose from different fund types depending on how much risk they are willing to take for the growth they would like their investment to achieve.

AIA Philam Life Elite Funds will be available through Family Provider and the MoneyWorks. This expands the options policyholders can choose from to grow the account value of their life insurance plans. They may transfer to or add the peso-denominated AIA Philam Life Elite Funds in their portfolio. With access to a global portfolio of professionally managed funds, customers will have the opportunity to grow their investment to meet their long-term savings objectives.

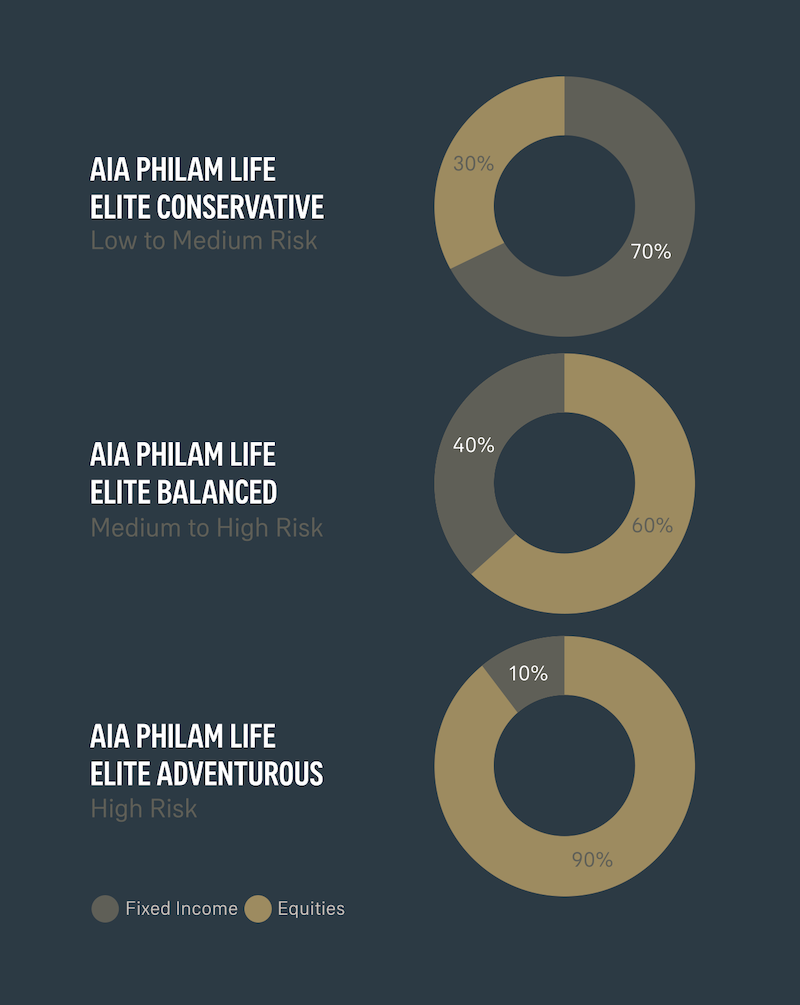

The Adventurous Fund

This is for high-risk investors who are willing to expose themselves to higher level of risk in exchange for potentially better returns. The Adventurous Fund seeks to achieve long-term total returns through a combination of capital growth and income by investing in a portfolio of mostly equities and a smaller proportion of bonds (90 percent Equity and 10 percent Bonds).

Balanced Fund

The Balanced Fund is the best match for investors who are low-maintenance or those who prefer modest risk. The Balanced Fund seeks to achieve long-term total return from a combination of capital growth and income with moderate risk by investing in a portfolio comprising primarily of equities and bonds (60 percent Equity and 40 percent Bonds).

Conservative Fund

The Conservative Fund is perfect for investors who prefer minimal risks. This fund aims to achieve long-term total return through a combination of capital growth and income by investing in a portfolio made up primarily of bonds and the remaining through equities (30 percent Equity and 70 percent Bonds).

AIA Philam Life has partnered with AIA IM in the development of these funds. AIA IM is an AIA-affiliated company incorporated in 2016 as the hub for regional investment management that solely manages the assets of the AIA entities within the AIA Group. Through this collaboration, AIA Philam Life is able to open to Filipinos the opportunity to invest in global investments.

AIA Group manages more than $244 billion of assets across 18 markets in Asia. It has a team of more than 150 investment professionals and access to the world’s finest global institutional asset managers. This partnership approach with external asset managers will help ensure AIA Philam Life Elite Funds will deliver consistent long-term results.

Baillie Gifford

Founded in Edinburgh in 1908, Baillie Gifford is one of United Kingdom’s largest and oldest investment management firms. They share a deep conviction that almost all the growth in equity markets in 85 years can be attributed to just over 1000 exceptional stocks. Hence, identifying and investing in such firms is key to wealth creation. They focus on such growth companies that can double in value within five years and have an exceptional record in achieving this.

Wellington Management

Wellington Management is a private, independent investment management firm founded in 1928. Their flexible investment style of Value and Growth Style together with their long-term and strong stewardship approach, investing in high-quality companies that not only have strong governance and integrity but also strong management team as they believe such companies can generate long-term sustainable growth.

BlackRock

Founded in 1988, BlackRock operates globally with offices in over 35 countries and clients in over 100 countries. BlackRock manages in excess of $8 trillion in assets and is the largest investment manager in the world. They have an exceptional platform and strength in analytics that allows them to deliver at scale. BlackRock focuses on top-down and bottom-up approaches through a mix of quantitative and qualitative techniques to target long-term sustainable results.

Ready to grow your investment and take it to the next level? You can achieve your long-term investment goals whichever type of investor you may be with AIA Philam Life Elite Funds.

Click here for more information about AIA Philam Life Elite Funds, or visit AIA Philam Life’s Facebook page. e-mail philamlife@aia.com or call 8528-2000.

***

Editor’s Note: This article was provided by AIA Philam Life.