The five myths about international investing

When it comes to investing, more and more Filipinos are turning to the Philippine Stock Exchange (PSE). With the majority of local investors relying heavily on the 30 Philippine-based companies in the PSE, experts are now urging investors to start considering diversifying their portfolios outside Philippine companies to get exposure to a significantly larger marketplace, giving investors a wide selection of stocks which may not be available in the PSE. In fact, investing in global companies exposes investors to many different economies, which in turn reduces the risk and volatility compared to investing solely in the local market.

However, international investments are typically uncharted territory for the regular local investor, as many find investing outside the country daunting and difficult given the complexities and unfamiliarity of the international markets.

Here are five common “myths” on international investing and the truth to address these, shedding light on the benefits of going global.

Offshore investing is riskier

It is a common misconception that investing offshore is riskier than investing in one's region or country. But with the benefits of diversification in one's portfolio, the opposite may just be the case: the exposure to different economies can help lower the overall portfolio risk.

You need to invest big

While there are advantages to dedicating large investments, it will not necessarily equate to larger returns. Companies like AIA Philam Life are creating product solutions that allow investors who wish to start small to get into the global market, with managed risk, and within their appetite.

Timing is key

The equity market is volatile so naturally, first-time investors assume they need to check the market when they buy and sell. It does sound like a sensible move to make, but we all know it is almost impossible to time the market correctly all the time. And for those who cannot do daily market monitoring, this can be very tedious and time-consuming.

To maximize the growth potential of investing in equities, investors need to adopt a long-term view and stay invested. All markets are cyclical and based on historical data, the sharpest falls are often followed by a recovery that when viewed from a longer perspective, generate positive returns. Instead of market-timing, focus on investing in the long haul instead.

More diversification is better

Diversified portfolios are good, but how much diversification is enough? Having too wide an exposure to different markets and products may stretch resources, but do not generate additional value-add. Well-executed portfolio construction and management are critical to ensure the mix of products and market exposure complement each other and generate additional returns while minimizing risk.

It’s hard to invest internationally

Markets from outside the country will inevitably operate differently. There will be corporate, political, economic, and market factors to consider when seeking investments outside the local market. However, AIA Philam Life, through its newly launched AIA Philam Life Elite Funds, makes it more accessible to invest globally with the expertise of experienced investment professionals to oversee these important decisions.

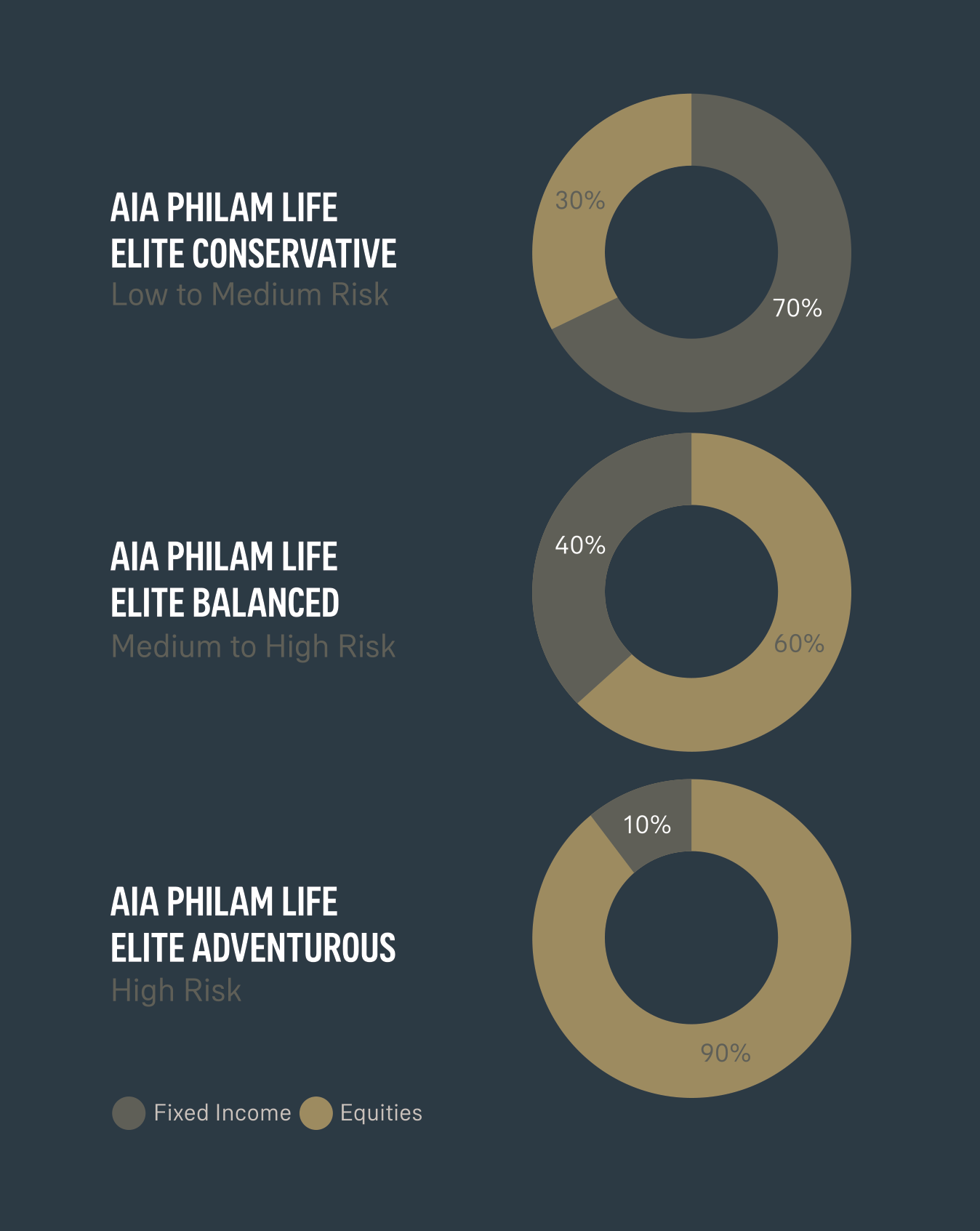

Through its unit-linked insurance products, the AIA Philam Life Elite Funds maximize the earning potential of common Filipinos' hard-earned money through global funds. Policyholders may choose from different fund types depending on how much risk they are willing to take for the growth they would like their investment to achieve.

The Elite Funds will be available through Family Provider and MoneyWorks. This expands the options policyholders can choose from to grow the account value of their life insurance plans. They may transfer to or add the peso-denominated Elite Funds in their portfolio. With access to a global portfolio of professionally-managed funds, customers will have the opportunity to grow their investment to meet their long-term savings objectives.

The AIA Philam Life Elite Funds are curated based on the customers’ risk profile and investment objectives. The Elite Adventurous Fund matches investors comfortable with a higher risk in pursuit of higher return, while the Elite Balanced Fund is perfect for those ready to take a moderate risk for capital growth. For those with a low-risk profile but still seeking a long-term total return, the Elite Conservative Fund is available. Each of these funds is uniquely created for AIA and managed by Best-in-Class asset managers.

AIA Philam Life has partnered with AIA Investment Management Pte. Ltd. (AIA IM) in the development of these funds. AIA IM is an AIA-affiliated company incorporated in 2016 as the hub for regional investment management that solely manages the assets of the AIA entities within the AIA Group. Through this collaboration, AIA Philam Life can open to Filipinos the opportunity to invest in global investments.

AIA Group manages more than $244 billion in assets across 18 markets in Asia. It has a team of over 150 investment professionals and access to the world’s finest global institutional asset managers. This partnership approach with external asset managers will help ensure the Elite Funds will deliver consistent long-term results.

The Elite Funds are invested in a combination of AIA Investment Funds managed by AIA IM and external fund managers Baillie Gifford, Wellington Management, and BlackRock. The underlying investments of the AIA Investment Funds include US Investment Grade fixed-income securities, offshore traditional stocks, and new economy stocks.

With the new AIA Philam Life Elite Funds, AIA Philam Life stays true to its commitment to empowering Filipinos to live healthier, longer, and better lives through long-term savings solutions.

Click here for more information about AIA Philam Life Elite Funds, or visit AIA Philam Life’s Facebook page, e-mail philamlife@aia.com or call 8528-2000.

***

Editor’s Note: This article was provided by AIA Philam Life.