Marcos has signed the Maharlika bill into law—here's what you need to know

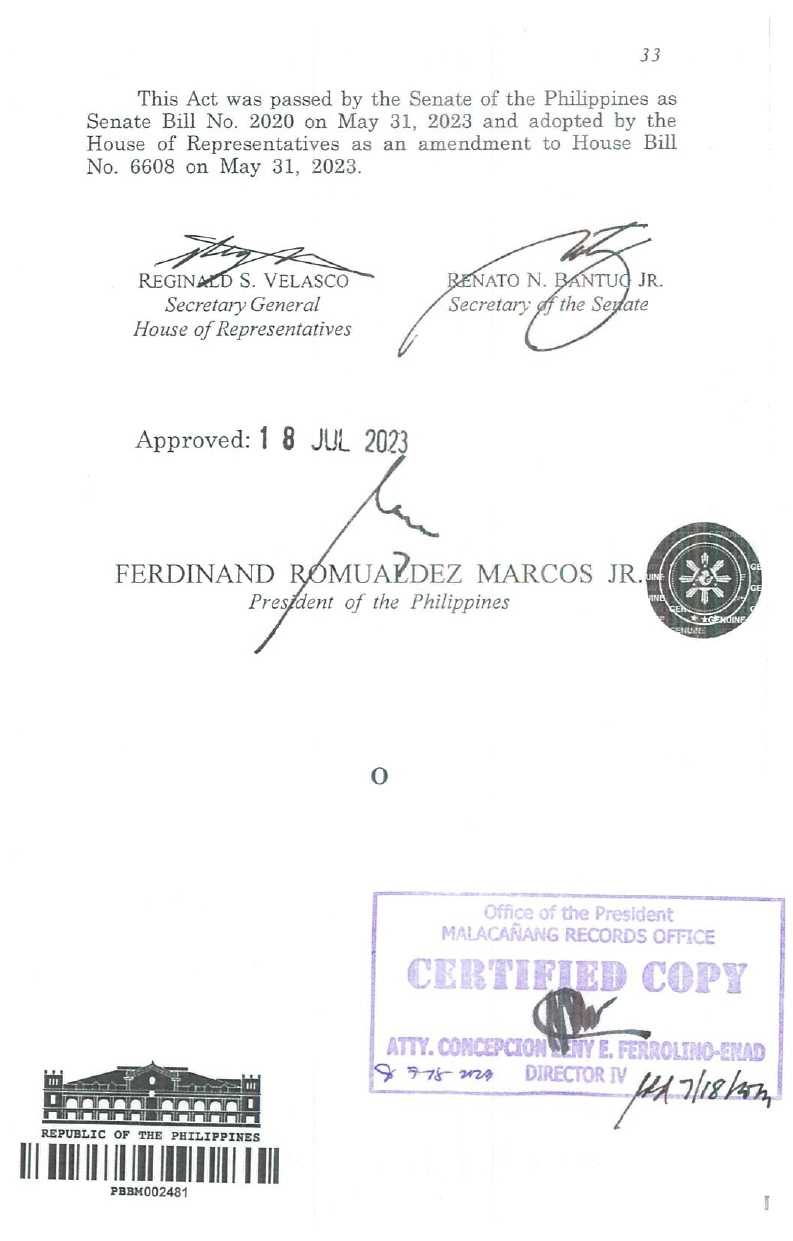

President Ferdinand "Bongbong" Marcos Jr. signed into law Republic Act. No 11954, the bill establishing the controversial Maharlika Investment Fund (MIF), on Tuesday, July 18.

The MIF, formerly the Maharlika Wealth Fund, intends to draw money from state-owned funds as investment to assets like foreign currencies, fixed-income instruments, domestic and foreign corporate bonds, joint ventures, mergers and acquisitions, real estate and high-impact infrastructure projects, and projects that contribute to the attainment of sustainable development.

Seed money will come from the Land Bank of the Philippines, P50 billion; the Development Bank of the Philippines (DBP), P25 billion; and the national government, P50 billion via dividends from the Bangko Sentral ng Pilipinas. The central bank is required to give all of its remittances during the first two years of the MIF's creation.

The MIF could be used to support priority programs and help fund government projects without the need for additional taxes, as well as be used to increase funds for social services like education and health via its projected investment returns.

The fund could also be used to finance the government's infrastructure and even agriculture projects without acquiring more debts, according to Marcos.

"For the first time in the history of the Philippines, we now have a sovereign wealth fund (SWF) designed to drive economic development," Marcos said in his speech during the signing, which took place six days before his second State of the Nation Address, and about seven months after the idea was first floated at the House of Representatives.

Final 'corrected' version of the MIF

The final version of the MIF, which was sent to the President, carried a correction from a prescription period of 20 years to 10.

In late June, Senate President Juan Miguel Zubiri explained the Senate's corrections on the enrolled copy amid accusations that it was "tampered" after its green light from both Houses of Congress.

“First of all, there is no such thing as tampering. There was never a plan to tamper, no sinister move to tamper the measure,” Zubiri said at the Kapihan sa Senado event.

“We just want to put on record that we just reflected the true intention, let me repeat, the true intention of the provisions as reflected in the transcript of records.”

“The enrolled bill, the one I signed in Washington D.C., is the truthful reflection of the intent of the members of Congress. That is the intent of the majority,” he added.

Maharlika Investment Corp.

The signed law also states the establishment of Maharlika Investment Corp. (MIC) to manage the funds.

The MIC will be governed by a nine-member board of directors comprising the finance secretary as chairman, Land Bank and DBP presidents, two regular directors, and three directors from the private sector.

Marcos, however, in his speech said the president and finance secretary shall not be part of the MIC to ensure decisions won't be mixed my politics.

The MIC will also have an audit committee comprising the board of directors and an external auditor, as well as a five-member risk management committee.

The Commission on Audit shall also conduct a special audit of the MIC’s books and accounts every five years.

The MIC is also required to submit internal and external audit reports to a joint congressional oversight committee comprising seven members each from the House and the Senate.

All MIF and MIC shall be open, available, and accessible to the public in English and Filipino, according to the law.

MIF misgivings

Critics have expressed misgivings over the MIF, citing prevailing economic conditions like budget deficit, mounting debts, and high inflation rate.

Filomeno Sta. Ana III, Action for Economic Reforms coordinator, in a Dec. 4 BusinessWorld column wrote that an SWF works when the country has a huge surplus.

Citing Norway as an example, Sta. Ana pointed out that the surplus from its extractive industries has been accumulated over the long term. Norway has the largest SWF in the world, providing about $250,000 per Norwegian citizen thanks to its oil and gas profits.

Other countries, especially from East Asia, also have big trade surpluses, according to Sta. Ana.

"The Philippines does not have the surplus generated from our extractive industries nor from our (underperforming) exports," he said.

Sen. Imee Marcos previously rejected the idea of the MWF due to the economic turmoil. “Is now the right time to invest? It’s quite high-risk as the global economy is so bad,” she told reporters.

Sen. Marcos said foreign models, particularly that of Norway, may not also be applicable to the Philippines.

Another reason is the cautionary tale that is the 1Malaysia Development Berhad (1MDB) corruption scandal. In 2020, former Malaysian Prime Minister Najib Razak was found guilty of pocketing billions from their SWF. Razak, his wife, and other officials are serving time in prison.

MIF 'well-run'

Marcos assured the public that the MIF "will be managed by highly competent personnel with a good track record and outstanding integrity."

He also highlighted the importance of making sure that the fund is "well-run" and that decisions being made for it are "not political decisions" but "financial decisions because that is what the fund is."

"We remain steadfast in our commitment to transparency, accountability, and good governance in this massive and purposeful undertaking," he stressed.

"The real challenge is to maintain the integrity of the fund [and] translate its gains into tangible changes for the benefit of all," said Marcos.

Find the Maharlika Investment Fund bill below.