You can invest in Google, Apple and Samsung for as low as P1,000

I like my money where I can see it: hanging in my closet.” So declared Sex And The City’s Carrie Bradshaw as an argument for choosing fashion investments. A quotable quote, but she was barely making rent and at one point was literally the woman who lived in a shoe. It’s entertaining TV, but in real life, not so much.

Using GInvest, mobile wallet app GCash’s latest product that streamlines and democratizes the whole investment process, seeing your funds rise higher on your smartphone can match what Carrie was feeling about her closet.

But it’s important to be consistent about it. “Investments take time. It’s not about a one-time big move but the consistency of nurturing that habit,” said Maxine Pinpin, GCash’s head of investments, during the Facebook webinar “GCash Money Talks: Gustong Mag-invest But Don’t Know How?” meant to get users into that investing mindset.

Content creators Melissa Ricks, Thea Bautista and Lou Sanchez were also in attendance along with host Jaz Reyes.

GCash has enabled Filipinos with digital finance. It is a godsend for cashless transactions, bills payment, buying insurance and mobile banking, especially during this pandemic.

There are other mobile wallet apps out there, but GCash has over 40 million users today because it’s just so easy to use. GInvest is the same.

“GInvest has a beginner-friendly approach,” said Thea, a finance blogger. “When you set aside money for savings, you get a yield of only 0.15% interest per annum. Investing in a fund can grow twice or thrice as much depending on fund performance.”

What funds are available?

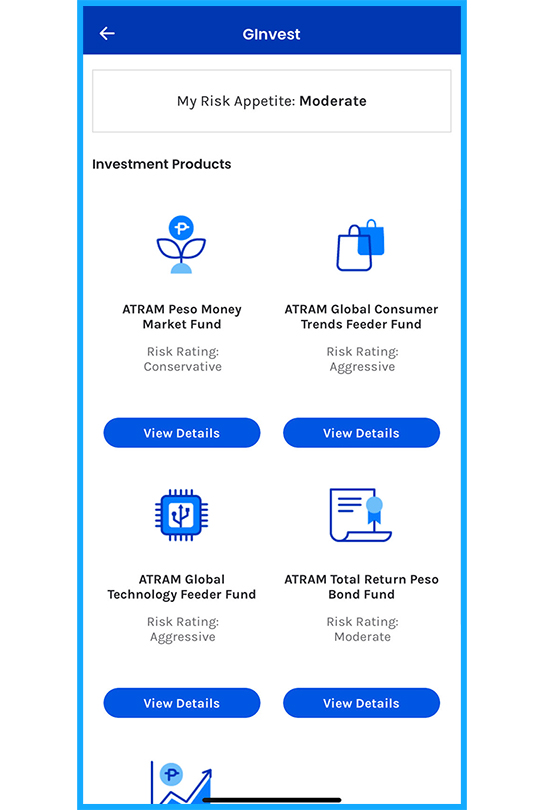

There’s something for everyone, whether you’re conservative, moderate or aggressive about investing.

“For this drop, we have two local funds and three global,” Maxine shared. There’s something for everyone, whether you’re conservative, moderate or aggressive about investing.

According to Maxine, Money Market Fund is a conservative fund where you park your money while looking for next-investment short-term investments like time deposits.

Philippine Total Return Bond Fund is moderate, giving you exposure to bonds for local companies and the government. Philippine Smart Equity Index Fund is aggressive; it allows users to invest in the local economy through the PSEi index of the top local companies in the country, such as BPI, Globe, and Ayala.

Global Technology Feeder Fund is also aggressive; it lets users invest in trail-blazing tech companies like Google, Apple and Samsung. Global Consumer Trends Fund is aggressive too, where you invest in companies innovating for consumers like Amazon, Alibaba, Shopee.

You can get started with a P50 buy-in for local funds and P1,000 for international funds. These affordable rates make GInvest by GCash the first fintech company in the Philippines to offer low investment buy-ins.

GInvest provides access to expertly managed funds with ATRAM Trust Corporation, the leading independent asset manager in the country, and Seedbox Philippines, a company which has introduced digitized investing in the Philippines.

But with a recession ongoing, is it even the right time to invest?

Thea thinks it’s best to take advantage of the current market situation. “The economy will improve in the next five to 10 years.”

What she does is put P1,000 investments in different funds. “Do not put all your eggs in one basket.” If things go well with your funds, the fashion investments in your closet can even welcome a new set of expensive friends.

GInvest by GCash is available for fully verified GCash users. For more information, you may visit their website