A simple way to get insured

What if getting insured were as simple as adding an item to your cart? With Palawan ProtekTodo, it is.

Designed to be affordable and easy to access through Shopee and Lazada, this critical illness protection policy fits right into today’s digital, on-the-go lifestyle.

The real problem

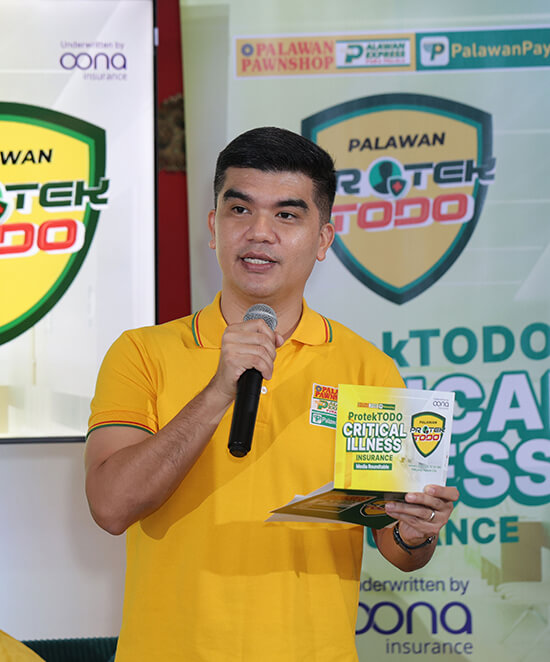

“In the Philippines, we continue to face a sad reality. Despite being a country that deeply values family and resilience, insurance penetration remains very low—only 1.8 percent as of mid-2025, according to the Insurance Commission,” says Karlo Castro, president and CEO of Palawan Group of Companies.

For many Filipinos, insurance still feels intimidating, too complex, too expensive, and simply out of reach. That leaves millions financially vulnerable when illness strikes.

“This is the gap we want to address. At Palawan Group of Companies, we believe protection should not be a luxury,” Castro adds.

What Protektodo covers

ProtekTodo Critical Illness Insurance provides essential coverage against three of the most common and financially devastating illnesses among Filipinos: heart attack, stroke, and cancer.

ProtekTodo is Palawan’s way of saying that no Filipino—regardless of socio-economic standing—should have to face critical illness alone or unprepared.

“By simplifying the process and bringing protection closer to where people already are, we hope to empower more families to take that first step toward financial security,” Castro adds.

How it works

ProtekTodo provides a 100% lump-sum cash benefit upon diagnosis, whether the illness is detected early or late. That means policyholders can use the money where it matters most—medical bills, treatment, lost income, or household needs during recovery. Coverage is available to Filipinos aged 18 to 60, with one full year of protection per policy.

Plans for different budgets

To suit different needs and budgets, policyholders can choose between two simple options:

- Basic Plan: P50,000 coverage for as low as P550 per year

- Plus Plan: P100,000 coverage starting at P1,100 per year.

You can also get multiple policies, with a total maximum benefit of up to P500,000—enabling families to build stronger protection over time.

Making insurance more accessible

Lisa Castro-Sabado, chief business development officer of Palawan Group, explains why partnerships matter.

“We partnered with Oona because of a shared commitment to reliability, accessibility, and putting customers first. ProtekTodo integrates insurance into everyday life—whether through our branches, the PalawanPay app, or e-commerce platforms.”

Bernard V. Kaibigan, chief marketing officer of Palawan Group, adds: “Many traditional insurance products feel intimidating because of complicated terms, high premiums, and long processes. ProtekTodo removes these barriers. It’s easy to understand, accessible, and gives real support when people need it most.”

Why it matters

As more Filipinos focus on health and financial security, ProtekTodo shows that critical illness coverage doesn’t have to be expensive or complicated. It can be simple, affordable, and available wherever you are.

True to its promise—“Patingi-tingi ang presyo, pero todo ang benepisyo”—ProtekTodo proves that a little protection can go a long way.

Where to get it

If you’re ready to protect yourself and your family, you can get ProtekTodo Critical Illness Insurance at any Palawan Pawnshop–Palawan Express Pera Padala branch, via the PalawanPay App, or through the official ProtekTodo stores on Lazada and Shopee.

* * *

Editor’s Note: This article was provided by Palawan Pawnshop.